GST Relief or An Unseen Illusion: The Unseen Cost Of GST Rate Restructuring.

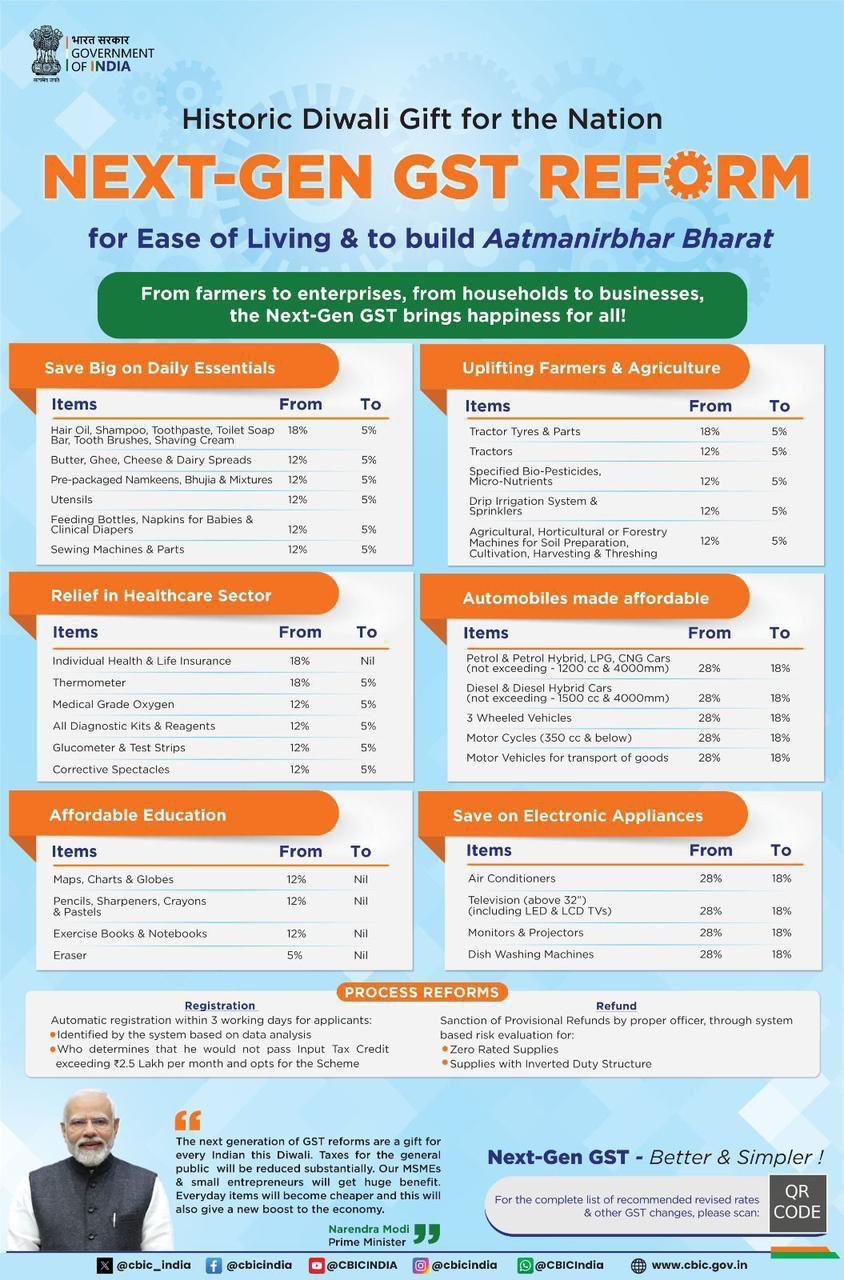

The GST Council has introduced Next Generation GST reforms by simplifying the tax framework into a two-slab structure-5% and 18%-while eliminating the earlier four-tier system. Most items previously taxed at 12% have been moved to the 5% slab, except a select few that now fall under 18%. Similarly, products taxed at 28% have largely shifted to 18%, with only luxury and sin goods retained at a higher 40% rate.

At first glance, the reforms appear consumer-friendly, promising lower tax burdens and greater affordability. However, a closer look reveals that the denial of Input Tax Credit (ITC) in several key sectors, along with structural rate anomalies, could actually increase costs for businesses-and eventually for consumers.

Why Lower GST May Not Mean Lower Costs

While reduced tax rates are often welcomed, they do not necessarily translate into lower costs across the board. For businesses where ITC is disallowed, the GST paid on inputs becomes a non-creditable expense, directly inflating operating costs. Similarly, industries facing inverted duty structures-where input taxes exceed output taxes-may see credits blocked, hurting profitability despite lower outward tax rates.

Hospitality: Hotels and Accommodation

The GST rate on hotel accommodation priced up to ₹7,500 per room per day has been reduced from 12% to 5%. While this appears to support affordable travel, the withdrawal of ITC has created a paradox.

Hotels incur substantial input costs on lease rentals, housekeeping, maintenance, and outsourced services, all taxed at 18%. With ITC no longer available, these taxes turn into unrecoverable costs. For many budget and mid-sized hotels, the cost of operations has risen, making it difficult to pass on the benefit of reduced GST to guests. Ironically, the effective room tariff could even increase, despite the lower outward tax rate.

Beauty & Wellness Services

A similar scenario exists in the beauty and wellness sector, covering salons, spas, and parlours. The GST rate here has also been cut from 12% to 5%, but ITC has been withdrawn.

These businesses often pay GST at 18% on inputs such as rent, equipment, consumables, and outsourced staff services. Without ITC, these taxes inflate operating costs. The reduction in output GST does not offset the increase in embedded input costs, leading to the likelihood of higher service charges for customers rather than lower ones.

Insurance Sector

The government has fully exempted individual health insurance and life insurance policies from GST. While the move aims to make insurance more affordable, insurers lose eligibility to claim ITC on services like reinsurance, third-party administration, and distribution.

This makes the GST component on input services an unrecoverable cost, which insurers may have to absorb or pass on indirectly through premium adjustments. Thus, while the exemption looks beneficial on paper, policyholders may not experience the full extent of savings in practice.

Garments: Readymade vs. Custom-Stitched Apparel

The GST rate on garments priced up to ₹2,500 has been reduced to 5%, but apparel above this value now attracts 18% GST (earlier 12%). Meanwhile, textiles/man-made fabric and tailoring services are both taxed at 5%.

This creates a sharp disparity between readymade apparel and custom-stitched garments.

For Example: A readymade Lehnga priced at ₹50,000 will now attract ₹9,000 GST (18%), making the total cost ₹59,000. Alternatively, purchasing fabric worth ₹40,000 and availing tailoring services for ₹10,000 would result in GST of just ₹2,500 (₹2,000 on fabric + ₹500 on tailoring), bringing the total cost to ₹52,500. The difference of ₹6,500 strongly incentivizes consumers to opt for fabric and tailoring over readymade apparel.

Further, anomalies arise with suit sets. If a coat and pant are sold as a set exceeding ₹2,500, the entire set is taxed at 18%. However, if sold separately with each piece priced below ₹2,500, both items fall under the 5% slab. This distorts retail pricing strategies and could alter consumer behavior.

Footwear

The same restructuring applies to footwear. Pairs priced up to ₹2,500 attract 5% GST, while those above ₹2,500 are taxed at 18% (earlier 12%).

Unlike garments, consumers cannot easily avoid the higher rate by opting for custom alternatives. While leather (taxed at 5%) and artisanal shoemaking exist, they are not practical or accessible for most buyers. This makes the premium footwear segment particularly vulnerable, with branded players facing higher costs and weaker demand.

Conclusion

The GST Council's reform aims to simplify the tax regime and provide relief to consumers. However, the withdrawal of ITC and widening rate differentials create hidden costs and distortions across sectors.

Hotels and parlours face higher operating costs despite lower outward tax rates.

Insurers may not fully pass on the GST exemption to policyholders.

Garment and footwear sectors see significant anomalies that could reshape consumer behavior and retail models.

In essence, while GST 2.0 promises relief on paper, its real-world impact may feel more like an illusion-where consumers and businesses alike end up paying more, not less.

Contributed by: CA Shubhi Khandelwal