Caramel vs Salted Popcorn: FM Nirmala Sitharaman Explains GST Categorization

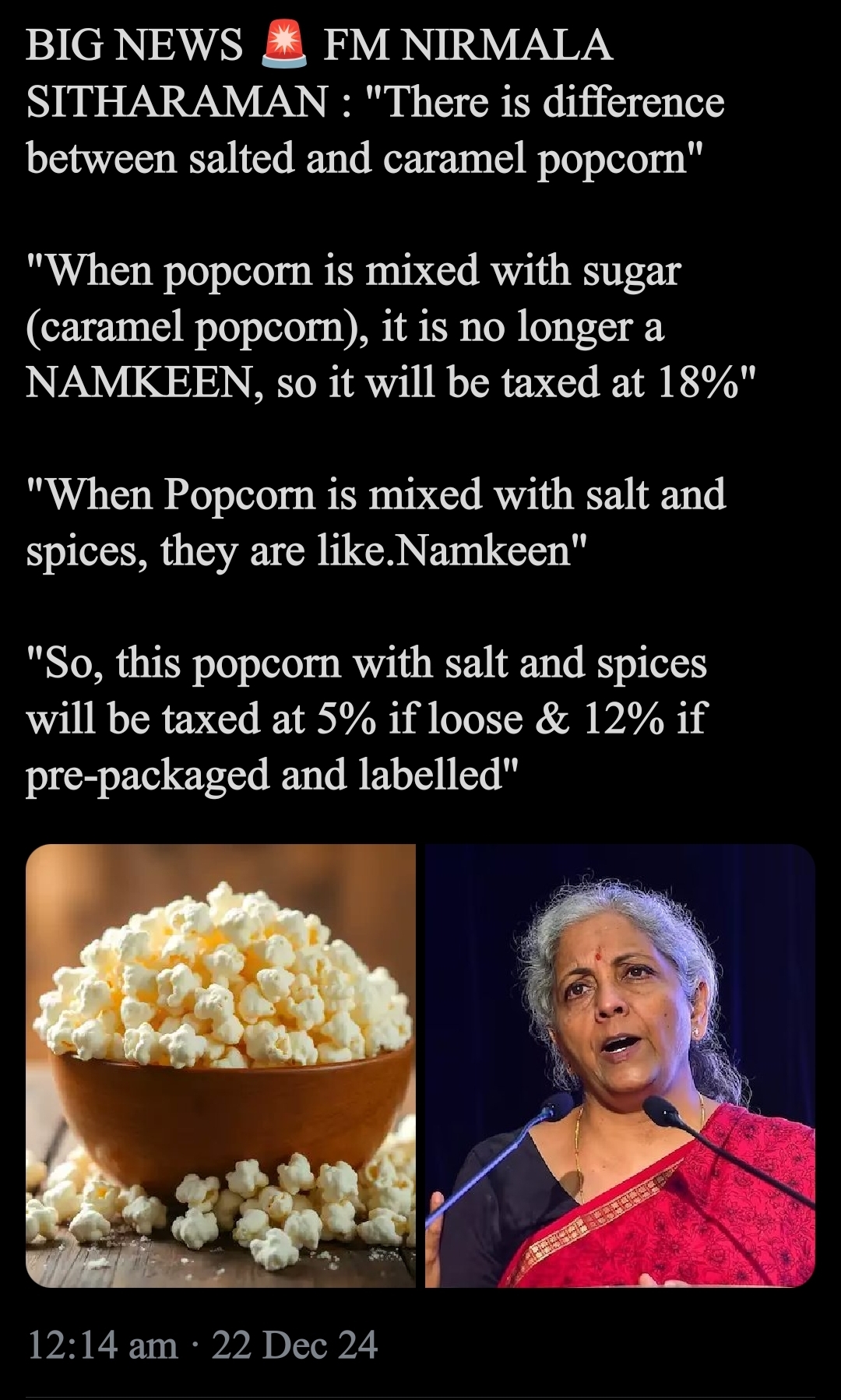

New Delhi, 22 December 2024 – Finance Minister Nirmala Sitharaman has clarified the GST (Goods and Services Tax) rates applicable to different types of popcorn, sparking discussions among businesses and consumers alike. Speaking on the categorization of popcorn varieties, the minister emphasized the distinction between salted and caramel popcorn, and how their preparation influences tax rates.

“When popcorn is mixed with sugar (as in caramel popcorn), it is no longer considered a ‘namkeen’ (savory snack). As a result, it will attract 18% GST,” Sitharaman stated. This move places caramel popcorn in the same tax bracket as other confectionery items, distinguishing it from traditional salty and spiced popcorn.

However, popcorn flavored with salt and spices receives a different treatment. Sitharaman explained, “When popcorn is mixed with salt and spices, it is similar to ‘namkeen.’” Therefore, the GST rates are significantly lower for this category.

5% GST applies to salted popcorn if sold loose and unpackaged.

12% GST applies if the same popcorn is pre-packaged and labeled.

The announcement highlights the government’s effort to clarify the application of GST laws based on product categorization. While caramel popcorn is treated as a sweet, its savory counterpart aligns with other Indian snacks like bhujia or sev.

Business and Consumer Reactions

This decision is expected to impact the popcorn market, especially for cinema chains, snack vendors, and packaged snack manufacturers. Businesses may need to re-evaluate their pricing and packaging strategies to accommodate the revised taxation.

On social media, the announcement has drawn mixed reactions. Some consumers have joked about the level of detail in tax policy, while others see it as a step toward rationalizing GST slabs for diverse food products.

This clarification also serves as a reminder for businesses to carefully assess their products' ingredients and presentation to comply with tax laws. As India's snack industry continues to evolve, such distinctions could play a critical role in shaping the market.

For consumers, the next trip to the movies might now involve pondering not just the flavor of their popcorn but also its tax implications.